Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

4th September 2023

In the ever-evolving ocean of investments, where trends and fads can shift like the currents of the oceans beneath us, it’s essential to keep a steady hand on the wheel.

Amid the chorus of voices clamoring for the latest high-flying assets, one must pause and reconsider the tried-and-true: bonds.

As financial advisors, it’s our duty to ensure our clients make informed decisions. That’s why we’ll discuss why abandoning bonds might not be the wisest move, especially in today’s dynamic market. There are several aspects to Bonds that have not disappeared over-night:

Vanguard, a stalwart in the world of financial advice and investment management, echoes our sentiment. They emphasize the significance of bonds in a diversified portfolio, and we couldn’t agree more.

Bonds have long been recognized as a haven of stability and income in portfolios. But in 2022 we all experienced rising interest rates and inflation, and decreasing Bond values in our portfolios. So should we throw the baby out with the bath water??

In an environment where market volatility can be a constant companion, bonds offer a buffer, a shelter of sorts, for investors. The regular interest payments provided by bonds can be a consistent source of income, even when the equity markets are on a rollercoaster ride.

One of the primary reasons bonds should not be abandoned is their risk-mitigating role. While stocks can be subject to wild price swings, bonds tend to be more stable in general. Again, 2022 was an exception to that rule, as was mid-1970.

A global bond fund can fall short-term too. They fell 5% immediately on the emergence of Covid 19 in 2020, yet finished the full year up 5-6%. That was 2020, and the fundamentals have not changed since.

They provide a dependable source of income and can act as a counterbalance to the inherent volatility of equities. Diversifying your portfolio with bonds can help reduce overall risk and limit potential losses during market downturns. They are a separate asset class entirely.

Moreover, bonds have historically demonstrated an inverse relationship with interest rates. When interest rates rise, bond prices tend to fall, but this inverse correlation can work in an investor’s favour. It allows you to buy new bonds at higher yields if invested in accumulating funds. As a result, you can potentially increase your income and returns over the long term.

One of the most compelling reasons to retain bonds in your portfolio is their income-generating potential. In a world where the hunt for yield is often a paramount concern, bonds continue to play a role. Within the fund they offer consistent interest payments, providing a source of income that can be used to cover expenses if distributed, or reinvested if accumulating, to fuel future growth.

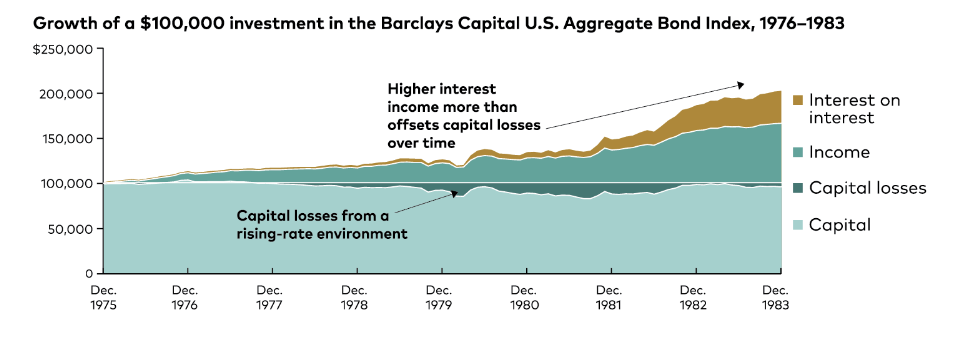

To use Vanguard’s excellent example, look at the bond bear market of the 1970s. As one born in 1980, I have no first hand experience of the 1970’s, but have heard of the 15% and 20% interest rates and high inflation rates countless times.

The 70’s was seen as a very rough time to have been invested in bonds due to both interest rates and inflation skyrocketing (as we have experienced in recent years).

However, Bond investors who reinvested their income returns (Accumulating Bond Funds automatically do this), and remained patient as compounding took hold, nearly doubled their capital from 1976 to 1983 in nominal terms. Had you held €100k of Bonds in December 1975, 7 years later, despite short term capital loss, you had almost doubled your money.

Over the longer term, bond total returns are driven much more by reinvestment of interest income on invested Bonds and compounding than by price returns. Net new investments in newer higher yield bonds replace lower-yielding bonds and so steadily lift overall yields in the portfolio!

This means that over time, the total return of the bond will increase. Investors need to look beyond the immediate pain of losses appearing in their bond portfolio statements to the longer-term upside of the current higher interest rates.

The importance of diversification cannot be overstated, and bonds play a critical role in achieving a well-balanced portfolio. By including bonds alongside stocks and other asset classes, investors can spread risk and enhance the potential for long-term growth while preserving capital.

Bonds act as a cushion during turbulent market conditions, helping to minimise losses and stabilise the overall portfolio. This preservation of capital is invaluable, especially for investors who cannot afford to take excessive risks.

And of course, we can say that that theory no longer applies, as 2022 saw many Bond Funds suffer more than most Equity Funds – but that was a once in a lifetime sort of occurrence. Could it happen again? Yes. Will it? Possibly. Should we totally dismiss Bonds as a result? No.

If you hold an Equity and Bond portfolio, you have 2 separate and different asset classes in there. In theory, when one is in turmoil, the other may not be. If you need to get your hands on some of that portfolio as income or as a lump sum, would you prefer to have the option of choosing from 2 asset classes to draw from, or only one? If you get rid of Bonds, you are down to one asset class. And while that may be an asset class with plenty of diversity in it, it’s still just one asset class!

While the siren songs of high-flying Equity and other ascending assets may be tempting many people to expose themselves to more volatility than they would otherwise do, the wisdom of holding onto bonds for the long term should not be underestimated.

By all means, if you can afford to, and can stand the volatility, have at the Equity. But don’t jump out of Bonds without due consideration of what you are trying to achieve, what you are taking on and what you are giving up.

Bonds more often than not will provide stability, accumulating income, risk mitigation, and diversification benefits that can be a lifeline in uncertain times.

As financial advisors, our duty is to guide our clients toward prudent investment decisions that align with their long-term goals and risk tolerance, not to run from anything that is temporarily not doing what we hope it will. Bonds should remain a segment of most well-structured investment portfolios.

Final Thoughts

Don’t be too hasty to abandon bonds. They are a time-tested and valued component of a balanced investment strategy. Sure, if you want all-out aggressive growth, you’ll likely not want Bonds, but otherwise, there is a case for them.

Perhaps embrace the diversity they offer, the income they generate, and the risk mitigation they can provide. Bonds might not be the flashy stars of the investment world, but they are the sturdy slice of most portfolios upon which sound financial futures are built.

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.