Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

11th March 2024

Bitcoin ETFs & Nvidia, taking a high risk dice roll or sticking to a prudent, long term strategy.

One of my favourite podcasts is The Compound & Friends featuring hosts Josh Brown and Michael Batnick of ‘Ritholtz Wealth’ in the US. They are irreverent, funny, informative and between them and their varied guests (they call them ‘friends’!) share some great insights and information.

In recent weeks they have touched on a wide variety of topics, but two in particular caught my attention most, and I felt might be worth sharing with you dear reader, in this weeks’ short piece.

Two separate news stories; one about the rapid inflows of new money into newly launched Bitcoin ETFs, and another about the rapid growth of the market cap and investor returns of a ‘world leader of artificial intelligence’, Nvidia.

But first – why am I talking about this? Well, when it comes to investing, I have always believed that success is more probable when we are investing in line with a plan, or at least a desired outcome and timeframe. I’ve always believed too that the probability of success in investing increases in line with the duration you do it over. The longer the better. Investing doesn’t need or shouldn’t be exciting or exotic – it should be boring and mundane! Well, the 2 recent news stories are anything but!

As of this year there are quite a few ‘spot bitcoin ETFs’ approved, and investors are piling in!

A ‘spot bitcoin ETF’ is an exchange-traded fund that directly tracks the current price of bitcoin. Unlike futures-based ETFs, which only trade bitcoin futures, spot bitcoin ETFs are meant to invest directly in the actual cryptocurrency.

My understanding is that they purchase a specific amount of bitcoins, which are then stored in digital wallets by custodians. The ETFs then issue shares representing the bitcoins held by the fund. These shares are priced to reflect the current spot price of bitcoin and can be traded on traditional stock exchanges.

Impact on Bitcoin Price: While a spot bitcoin ETF does not directly affect the price of bitcoin, its approval appears to be having an effect on the price! The creation of spot bitcoin ETFs has seen a rapid surge of investors, who will now find it easier to invest through ETFs rather than directly owning bitcoin, and all the kerfuffle that goes with that. This increased demand for bitcoin could potentially be boosting its price.

The approval of the first spot bitcoin ETF in the U.S. also appears to be somewhat of a milestone. Does it legitamise it? Does it mean it is now a recognised asset class just like equity, property, bonds, alternatives? Or is it simply the fund managers finding a way to cash-in on the demand that is obviously there!?

Blackrock were just one of the fund managers to list a spot bitcoin ETF (IBIT), and to read their marketing, you’d conclude that their Bitcoin ETF is ‘an expression on increasing global disorder and a declining trust in governments, banks and fiat currencies’!! Bit dramatic isn’t it!?

But the point here is that IBIT has seen a huge influx of investors – and is the fastest ETF ever to have grown to $10Bn. Ever! And as of 11th March it stands at $124Bn! Blackrock charge 0.25% fee on the fund – so they will earn c$300 million on that ETF alone per year, at that market cap. You can see why they are keen to offer it to hungry investors.

IBIT is up in value by 48% since it was launched on 11th Jan 2024. Not shabby. How much of that is down to sheer demand? Some say that is all that Bitcoin has to offer as an investment vehicle; demand and supply (which is finite!)

Is it a long term asset for us to invest in? Or is it as Warren Buffett suggested; a gambling token that doesn’t have any value? All I know is that if I was investing my financial future, I would approach with caution.

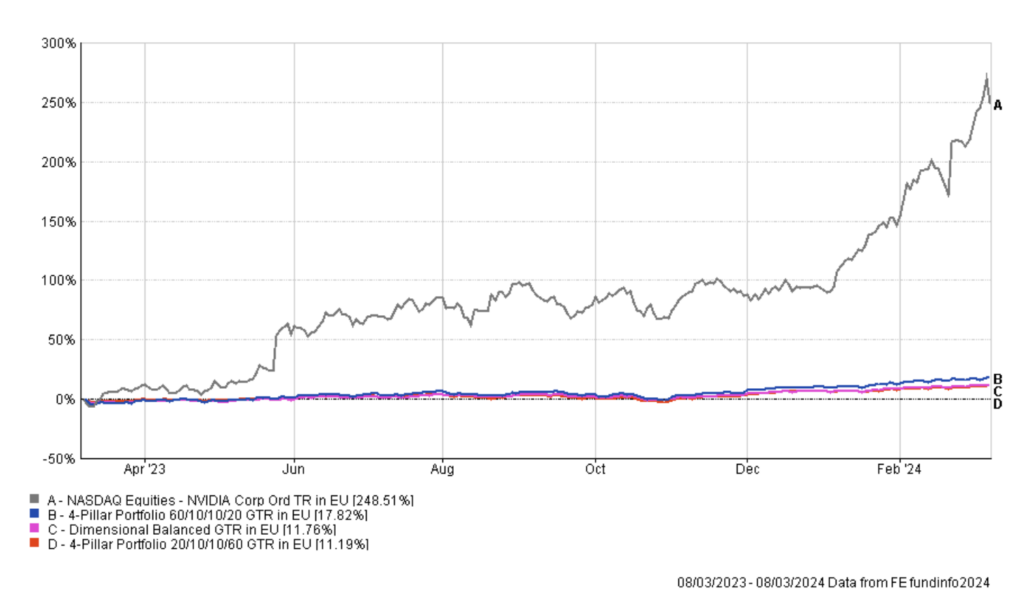

I mentioned steady-eddie boring investing earlier. Here is a perfect example of it; an 80/20 Equity/Bond portfolio and two conservative portfolios of c50/50 and 40/60% portfolios over the past 12 months only. Your 80/20 has delivered c17% with your conservatives delivering c11% each. Higher than the norm but fairly consistent with long term historical average returns relatively speaking. As an investor of your long term retirement or college education funds, you’re reasonably satisfied with that 12 month period.

Now lets include Nvidia in the mix; and boy does your 17% or 11% look bad now! Nvidia is up 248% in the past 12 months (despite falling c10% in the past few days!). Or in other words, about 20 times better than our preferred approach!

Michael Batnick shared that in just 6 days recently, Nvidia added $60Bn each day on average, through share price growth alone! Over the course of 6 days, Nvidia’s market cap grew by c$366Bn. It’s growth in those 6 days was bigger than the market cap of all but 19 companies in the S&P500!!!

As of 11th March 2024 it’s Market Cap is $2.19 trillion – heading towards being as big as Apple at c$2.6 trillion. It has gone bananas.

Had you invested €1m in Nvidia a year ago – it would be heading for €4m in value today. But not many of us are that well-off to throw the dice on €1m are we!? But there is no denying it – lets say you are in your 40’s and you have accumulated €1m in pension or investments – and you have a target of €3m to get to before you are comfortable that you ‘have enough for life’ – that investment would have got you there. But would you do the same bet today? Or would you see it as potential financial suicide to do such a thing?

And that’s the point here. How desperately do you want to double or triple or quadruple your money in a short space of time? If you are really really desperate, perhaps you’ll roll the dice on an in-vogue stock. Perhaps you’re willing to risk losing it all for the chance at making it all. It reminds me of the Youtube video of a guy betting his life savings on 1 spin at the roulette wheel. Search ‘Red or Black? – Betting your whole life on one roulette spin’. It’s scarily engrossing!

Through our non-standard yet highly secure approaches to our clients pension and investments we can help them access any listed asset or stock, including the ones I’m referring to today, but I won’t be recommending them as protective, proven & prudent long term strategies.

If a game of roulette is your thing – best of luck and I genuinely hope it works out for you. For the vast majority though – they might want to have a tiny slice, if any, of that action, but will stick to the boring road for the vast majority of what they are accumulating.

I hope this helps.

Paddy Delaney QFA RPA APA

Disclaimer

___

The content of this site including blogs and podcasts is for information purposes only. Everybody’s financial situation is different and the content we share on our site and through podcasts may not be applicable to you.

The articles, blogs and podcasts are not investment advice. They do not take account of your individual circumstances, including your knowledge and experience and attitude to risk. Informed Decisions can’t be held responsible for the consequences if you pursue a course of action based on the information we share.

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.