Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

8th April 2024

Fisher Investments have been around the USA a long time apparently, and recently set-up shop in Ireland, but are Fisher Investments Ireland any good, I hear some ask? Are they a fish out of water, or are they a saviour landed on our shores! Lets find out!

One of the things that I enjoy about being a truly independent financial planning firm is that we aren’t beholden to any investment firm, solution, fund or company. With our clients consent we can and will use any proven, prudent, efficient and optimal solution available.

As a result, we keep a constant review of all the regulated offerings and solutions available, with the intent of ensuring that the valued clients who chose to work with us never miss out if there is something better out there.

It’s a great feeling for us as a firm, knowing that we really are prioritising client outcomes, and it gives clients confidence that they are in the right place (even when things aren’t going positively, such as in 2020 and 2022!!). Fisher Investments Ireland was one such service that we reviewed over recent times.

I first became aware of Fisher Investments at a conference in America a couple years ago – they were referred to as the ‘mail shot advisors’ by a high profile speaker, which was greeted by sniggers in the audience.

When I asked a fellow attendee what he was referring to, I was told that Fisher Investments are well-known in USA as an investment firm that has grown from the 1980’s grew by sending hundreds of thousands of marketing envelopes to homes all around America every year. That was their sole means to growth – fire enough ‘you know what’ and some of it will stick, is what I was told.

And sure enough, since then they have come to Ireland, advertising their services. If you have ever searched an investment term on Google, you will surely have since seen an advert for Fisher Investments pop up in your browsers.

It usually features a handsome looking guy in early 50’s and a slogan saying something like ‘how to generate retirement income with a pot of €500,000’, or some such. They must be spending hundreds of thousands per year on google advertising. And it works for them!

Quite a few times in the past 2 years I have been told by people that they have clicked the link, followed the sales funnel, and had email chats or zoom chats with the resident Fisher advisor in Ireland. They are then repeatedly contacted and contacted by the ‘advisor’ to influence them to move their funds across to Fisher Investments Ireland. Their marketing strategy is obviously working for them, but does it work for the investors.

Lets look at initial findings on the key themes of transparency, fees, performance and service – 4 key cornerstones of any firm that you might be considering.

They speak about simple fees, independence and total transparency. However, there is no mention of their fees on their website. I emailed them over a year ago asking them for details of their funds, service and fees (I was doing my own due diligence and assessing if they could be useful for our clients in some way).

Sadly, I got no reply from them. And there is a dearth of actual information on their website about specifics of service, funds or fees. Fisher Investments Ireland has not done well on transparency.

Closely linked to transparency of course are fees. We publish our fees for the world to see – we like people to know what we do, how we do it and why we do it.

Fisher Investments Ireland do not disclose fees on their website, and make it very difficult to know what you will pay – despite informing the reader that their fees are all very simple and easy to see! I did receive an email from a lady who spoke with them and she was quoted a year-1 fee of over 3%. And I did find one reference in Ask About Money, where a poster stated Fisher Investments Ireland quoted c1.7% annual fee, made up of the following:

1.7% per year appears on the high side if you are investing in passive index funds, and about normal for Discretionary Managed funds. Again, not clear from Fisher if this is passive or active service fee.

Through some forensic investigations on my part, I found this link which shows you all the UCITS funds and their respective KIIDs documents – none of this is listed on their website, they don’t make it easy to find! fisherinvestments.com/en-gb/ucits.

Through it you will see that some of the funds have ‘on-going charges’ on the funds themselves of 1.95% etc., which would push your actual annual fees well above 2%, possibly closer to 3% from what we can make out. Again, they have not replied to clarifying questions.

This is where we see, in this Fisher Investments Ireland review, if they are the real deal as a possible solution, or not! Again, very difficult to find performance data, so I used our own performance research tools to dig deep to get clarity on the performance of some of their funds.

I ignored their USD and GBP funds, and selected only their Euro funds. A lot of the funds were only started in 2022 (lots of them appear to have been started only 1-2 years ago), and where possible I chose the funds that have been around longest (disappointingly most of the remaining are only around 4-6 years max, which is not a long term over which to assess performance). So we are left with the following from Fisher Investment Ireland:

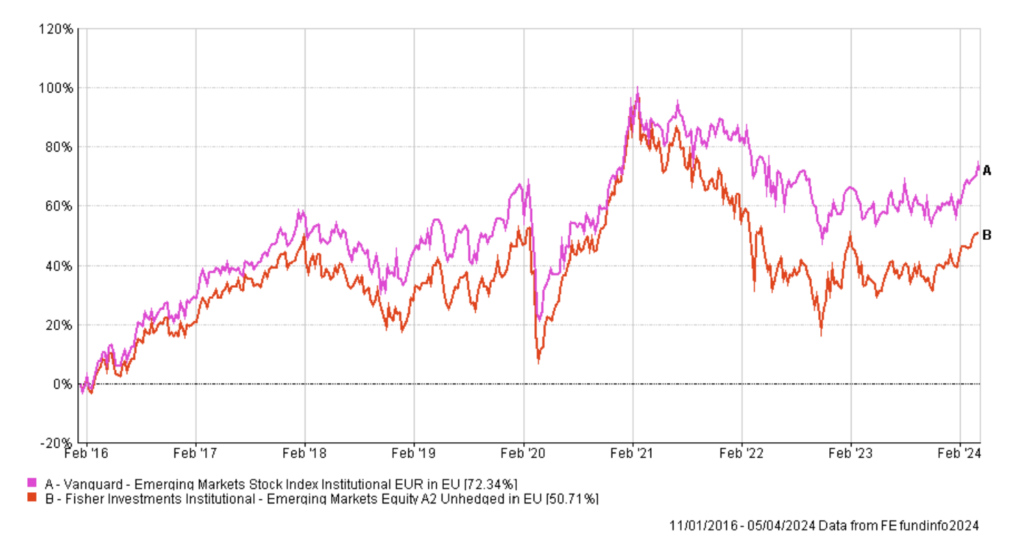

Emerging Markets – Fisher Investments Ireland vs Vanguard

One of Fishers’ oldest EUR fund is their unhedged Emerging Markets Fund, which started in 2016.

Stacked against Vanguard’s EUR Irish domicilled UCITS fund, it has underperformed very significantly.

€100k invested in each since 2016, and you’d have over 20% more in the Vanguard Fund than Fisher Investment Ireland. Not suggesting Vanguard is the best in the world, but it hits the benchmarks.

Not good for Fisher with their Emerging Markets Fund.

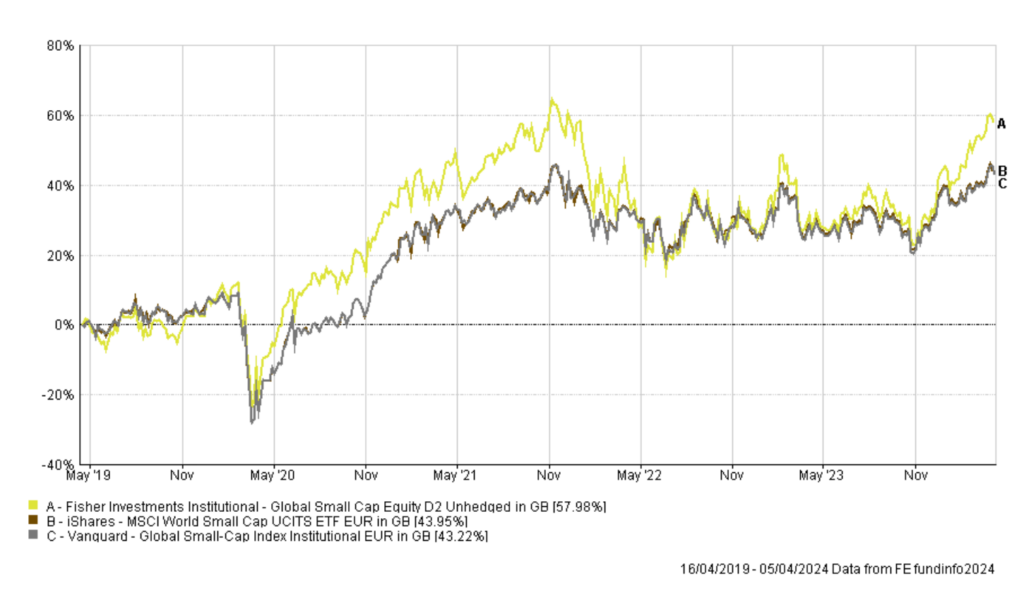

Small Cap Equity

Next we look at the Global Small Cap fund, and how it has performed since it was started in 2019 (again, not a long time!)

Well there you are! Fisher Global Small Cap Unhedged out-performed both BlackRock iShares and Vanguard EUR UCITS funds over that period.

€100,000 invested in May 2019 would be up c14% in Fisher than in either BlackRock or Vanguard.

A win for Fisher!

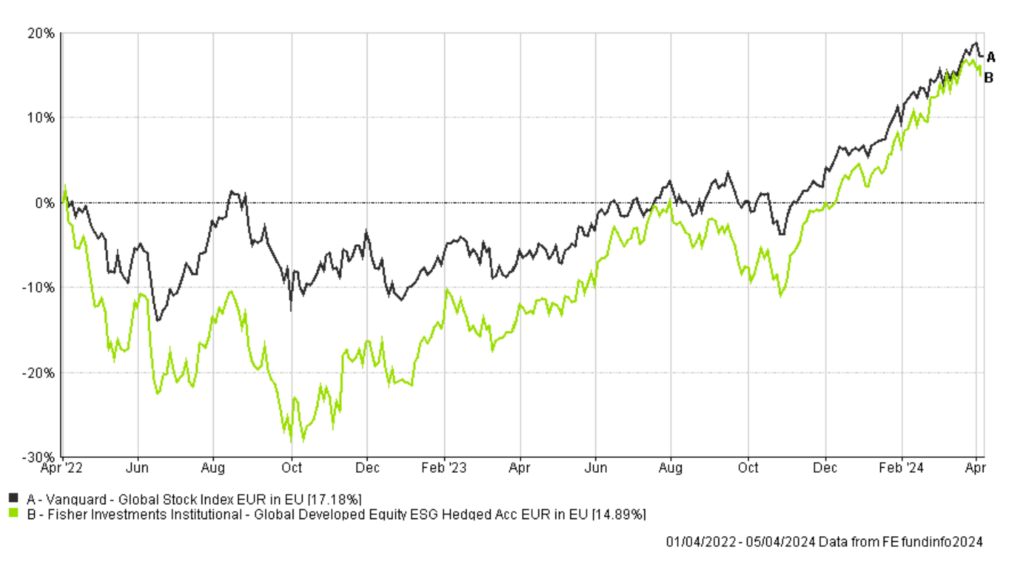

Global Developed Equity

This is the big one! If they get this, the core of many a portfolio, wrong, they are in serious trouble! Apologies, their Global Equity euro fund is only up and running 2 years ago – so not much in the way of long-term meaningful comparison.

Well there you have it, Fisher lag Vanguard by nearly 3.5% in 2 years.

And what is really scary is that Fisher Investments Ireland lagged Vanguard Global Stock UCITS by over 15% after only 6 months of the funds’ inception – what were they doing!!??? No thanks. And given that their own KID documents disclose fund fees alone of often 1.5-2% versus Vanguards’ 0.2%, could make one wonder.

I’m not a performance junkie – and there will be periods where even the best long term solutions will underperform other things – so please don’t take the above as a death-nail.

There is an expression along the lines of ‘follow the money’ to find your answers, and perhaps the intent. A very professional peer recently told me he was cold called by a recruiter to interview for a ‘financial advisor’ job with Fisher Investments Ireland. He was informed that the job was to ‘hunt’ clients, and to ‘close between 3-6 new clients each month’ from the 100 leads he was to be given by Fisher marketing department (these leads are YOU if you click their ads and enter your email. If you do that, expect to be hunted!?). He was told he’d get a salary of €100k and a bonus of €5k for each new client he signed-up each month. So, if he signed-up 3 clients per month average, he’d be on track for a salary plus bonus of €280k – for basically cold-calling over the phone, wow! This type of remuneration model, of ‘hunting’ clients, would not lead one to believe that on-going service is a priority. My professional peer declined the offer to do an interview.

I have not experienced their service first-hand so cannot comment on this. It is hard to tell if their focus is on actively managing a portfolio to squeeze returns for you (not apparent from above), or helping you develop and navigate a clear financial plan, or to help you achieve some specific financial goals, or merely to get you in the door and not bother with you again!?

It’s unclear if they have a team of advisors or not, or if they have a high degree of staff turn-over. We know it is not Irish owned, it is not independent, we don’t know who works there (unlike our own brigade!), that it hawks/sells it’s own funds, and that transparency, fees and performance are not what one would call ‘amazing’.

It isn’t for me to say whether Fisher Investments Ireland are any good or not, or whether you should or shouldn’t use them. Please, do your own research to help you decide.

But I do hope that this has been helpful in answering the question of ‘Are Fisher Investments Ireland any good?!’ and understanding some of the aspects of any investment firm to review and assess before jumping in!

Paddy.

Additional Flag: We did discover a Central Bank of Ireland warning stating that Fisher Investments Ireland Limited is a regulated entity but a fraudulent clone of the company had been identified, which we would all love for everyone to avoid, so please see here for CBI warning of same: Central Bank of Ireland Issues Warning on Unauthorised Firm – Fisher Investments (CLONE)

Disclaimer

___

The content of this site including blogs and podcasts is for information purposes only. Everybody’s financial situation is different and the content we share on our site and through podcasts may not be applicable to you.

The articles, blogs and podcasts are not investment advice. They do not take account of your individual circumstances, including your knowledge and experience and attitude to risk. Informed Decisions can’t be held responsible for the consequences if you pursue a course of action based on the information we share.

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.