Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

8th March 2021

Talking about the current state of markets at any given time is of absolutely no value whatsoever to the long term passive equity investor, hence I don’t do it. However, talking about the current state of the financial services in Ireland is one that is somewhat within our control, and definitely one that impacts us all in the here and now. Bit of a rant this week – bear with me.

This week the reputation of Financial Services in Ireland in particular has yet again been hammered – due to the appalling behaviour of individuals in a large financial services firm. It’s not business, it’s personal – my hole.

Financial Services reputation has been trying to claw its way out of the gutter for the past 10 years – and now Davy’s latest news drags it back in. Why would anyone trust anything they are told or advised to do when we have revelations like we have had over the past week. If I was not a financial advisor I don’t think I’d engage with financial advice either.

I think I’ve mentioned Edelman Trust Barometer here before – it’s the world’s most highly regarded and indepth analysis of consumer Trust.

They conduct this global study of Trust every year and it carries a lot of weight. Financial Services has consistently scored the lowest of any sector for trust since 2012. Over the past 9 years, the industry has climbed 8%, perhaps as people forgot all about the Global Financial Crisis. However, as of end of 2020, only 52% of people had any level of trust for Financial Services, whereas 68% trusted Technology Companies (and we know there is a savage amount to distrust about much of that!).

Aside from all the scandals in financial services globally I do think that another reason consumers don’t trust financial services I because of financial loss through poor investment vehicles, or indeed poor investment returns. Imagine you were an uninformed investor – you are told by an advisor that you should get 5-6% returns per year over the long term but you are not aware that in order to get that level of return you need to ride-out some massive market shocks. What is your reaction then when markets fall by 30% the following year – you assume you’ve been put into some Ponzi scheme and you pull your money out and you never trust advice again.

The blame of course does not sit with the investor here, the blame sits fully with the advisor. Warning of market declines should not be given to people in order to ‘Cover Your Ass’ but rather to educate and inform and help people to see how these things really work! The onus is on the financial services profession to give full disclosure around fees, around how this stiff actually works, around what could go wrong – warts and all. That leads to better educated, better informed investors who achieve better outcomes. Fail to do that and the financial advice sector of financial services will cease to exist, and people will continue to avoid the very advice that will deliver the financial life outcomes they actually seek.

I was talking about Marginal Gains last week in our Webinar with Kel Galavan. At the time I was trying to capture or summarise in 2 minutes all the aspects of our personal finances that can help make/save the extra little bit each year. These small gains, when accumulated over the long term can deliver massively significant differences of course. The ethos of pursuing Marginal Gains is a very credible and some say game-changing approach to performance, of any sort.

James Clear (Atomic Habits author) wrote a great piece about Marginal Gains. In it he quotes Davy B as saying

“The whole principle came from the idea that if you broke down everything you could think of that goes into riding a bike, and then improve it by 1 percent, you will get a significant increase when you put them all together.”

Davy Brailsford – Team Sky

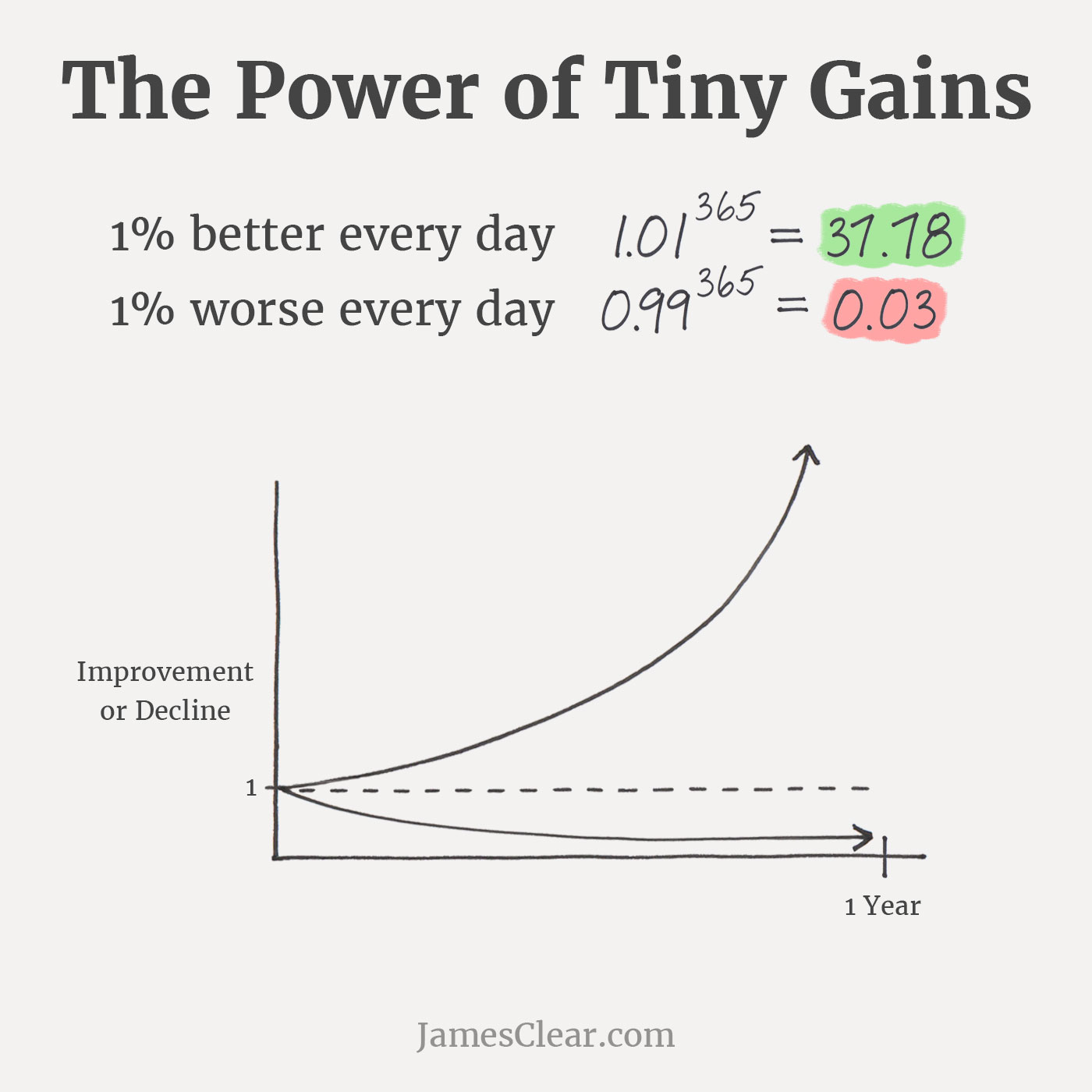

I’ve also included a cracking graph below from www.JamesClear.com which shows the impact of an aggregation of marginal gains, showing the impact of getting 1% better every day over the course of a year, versus getting 1% worse every day over the same period.

Starting at ‘1’, and improving 1% every day you’ll hit 37.78. On the other hand, if you instead get 1% worse every day you’ll hit 0.03 after 365 days. Which sounds better growing 1 to 37 or growing 1 to 0.03!?

‘Davy’ Brailsford led British Cycling to fame rode to fame – many believe due to the effots to generate ‘marginal gains’ such as nice pillows and chefs – others believe he led it purely by being smart about how to use performance enhancing drugs.

While many were disappointed for the sport, I was not surprised when the house of cards sort of collapsed around Team Sky. The revelations were damning of much of their decade-long reign as ‘invincibles’. Following revelations of failed drug tests and multiple court cases their reputation was shattered. In a way it was inevitable, the writing was on the wall! No team had ever cycled so well, so fast, so consistently in history without having been off-side in some way shape or form. For a reasonable period of time cycling had been polishing it’s image – there were no big drug revelations, we were starting to believe that cycling really had gotten rid of the cheaters. (If you are a Netflix user, check out the Icarus movie where an amateur rider takes performance enhancing drugs – it’s quite a ride!).

In the end ‘Davy’ Brailsford appears to have been telling some porky pies over the years, supported by unscrupulous doctors and team members. Some still say that Sky did nothing wrong. just as in financial services it is often very hard to tell the truth from fiction. Depending on what or who you read you’ll have different perspectives. Certainly at Team Sky, all was not as it seemed. Some say their entire record was built on lies and deceit.

Last week’s news about the other Davy in many ways reminded me of Team Sky. The rise, the fame, the growth, the glory. I know people who work with them, that have gone into business with them – good people. I fear that they, just like the reputation of the entire bloody financial services profession, will suffer as a result of the behaviours and decisions and greed and potential criminality of a group of idiots within the firm.

The only rock star I ever actually met was Neil Hannon from The Divine Comedy – bumped into him in the beer garden of a pub in Drogheda about 20 years ago – I said something to the effect of ‘You’re a legend Neil’. His reply was along the lines of ‘But I’m still alive’.

Thom Yorke wrote the song ‘the bends’ – the opening line being;

Where do we go from here? The words are coming out all weird, Where are you now when I need you?

Radiohead 1995

I feel those words could be said by anyone in this country now if they are seeking real help from financial services today – where do we go from here?

In the past couple of days we’ve seen the ‘Davy Gravy 16’ start to bow to the pressure – resign (with benefits of course), and we’re now see the same old calls for a deeper political investigation, possibly criminal investigations and a promise to reform. But really, how will all of this be any different to any previous scandal in financial services over the past few decades. Will anyone really be held accountable? Will anything really change? I’m a rational optimist, but I am not seeing any concrete change in the culture within financial services. It pains me to admit that I’m not convinced that that old sleveen culture is actually going away.

The very same thing happens in cycling – a few cyclinsts get banned for a period of time – some resign – some teams get disbanded only to reform under a new name (Sky basically rebranded and continue as they were) – the same culture of deceit and lies and greed pervades to this day.

Take Waterford native Sammy Bennett. In the past year he’s won sprint stages of the Tour De France and just won the opening stage of Paris-Nice at the weekend. As cycling fans we’re obviously delighted for him – he’s trained hard and has massive natural ability. But because many people don’t or can’t trust cycling as a sport, some people are probably wondering if there might be a little something untoward involved in his success- even if there is no logical rationale for such a suggestion – many of us have seen it too many times, we want to but we can’t trust it. It is a crying shame that this is the reality. In many ways it is the same in financial services in Ireland.

It depends on what we mean by financial services!? One aspect of financial services that I firmly believe stinks is anywhere there is complexity. Where there is complexity there is an opportunity for providers/ advisors/ companies to take advantage. It is here that investors are more likely to make mistakes, to lose their capital entirely, to be over-charged, and for things to not be as they seem. This is exactly what happened in this case that has come back to haunt Davy (not to mention their customer – who I hope got a great settlement for his troubles).

In any and all investing and pensions in Ireland there is scope for abuse of investors. I’m not being over-dramatic here, and it pains me to verbalise this. It is really regretful and shocking to think that today a person who has an insurance based pension will rarely get written confirmation of all the fees that they pay in their pension. Because there are no Key Investor Documents required on such schemes, investors do not know what they really pay.

To make matters worse, they are lied to at every turn. Someone was in touch recently, told me that they spoke to a broker about setting up an ARF – this person told me that the broker told them they will set up the ARF for them, and the total fee on the ARF will be 0.5% per year. The broker said that they wouldn’t charge the client an actual fee, stating instead that the ‘insurance company will pay me for setting it up and then for managing it each year, so you don’t have to pay me’. Some disclosure!

It’s safe to assume this anonymous broker takes the standard commission on such insurance-based ARFs of between 2% and 5% up-front/initial commission from the insurance company. It’s also safe to assume they’ll take the standard 0.5% trail commission from the insurance company. Can this investor really believe that the total fee that the insurance company are taking in fees each year from their fund is 0.5% per year?! Welcome to financial services in Ireland.

Fees are only part of the problem of course – but it is in my mind, the root cause of the lack of trust between consumers and financial services. Consumers believe, and possibly justifiably, that everything they are told is motivated by a greed for more commission- usually paid invisibly via the products they buy.

On the other hand if you look at a mortgage for instance. Within a mortgage one can see what you pay each month on a capital and interest mortgage. In addition you get a statement to show what you paid, and an Interest Certificate each year to tell you how much interest you paid over the year.

Even there, where there is total clarity in fees, no implicit fees, where everything is detailed to the cent, there are scandal after scandal of over-charging and negligence by the country’s biggest banks! As much as I hope I am wrong, can we really trust something where there is zero disclosure on fees!? Just imagine how much is going on where there is no disclosure and no visibility of transactions such as in most of the country’s pension and investment funds.

Independent or not, one of the things that I am most proud of in how we operate at Informed Decisions is that everything is visible – in as far as is feasible, there is nothing hidden or opaque. It creates extra work and extra explanation and extra figuring out for clients because there is more transparency and disclosure. Like me, it is black and white! Maybe the future of financial services will be more black and white? Recent and upcoming changes in regulation and compliance are trying to add more and more disclosure and transparency. Will that help or will that just add to the confusion in financial services in Ireland. Perhaps it will help, but will it be enough to restore or indeed to build trust in financial services in Ireland. We’ll see!

Hopefully financial services in Ireland is not ending! If you consume lots of ‘news’ then some will say that your world-view may be a little distorted! I like news but I have come to realise that ‘if it bleeds it leads’. Negative news grabs our attention more than positive news, so media companies obviously produce more of the former in order to make money. Human nature.

A really interesting book I read a couple years ago was ‘Factfulness’ by Hans Rosling. In it, this physician, academic (and his two adult children both Statisticians) lay out fact from fiction. It is quite amazing how our view of the world, broadly speaking, if far bleaker than reality!

Ola Rosling, Hans’ son has created ‘GapMinder’ a really interesting interactive website where you can do some quick Quizzes to see how pessimistic your world-view is. Check it out here and see for yourself!

I fully realise that the above is a less up-beat tone than usual from me, but I’m frustrated at where the reputation of financial services in Ireland is at. The reputation across all of financial services has been shaped over decades of greed from the most powerful members of some of our most powerful and largest financial institutions. It’s a bloody disgrace.

I empathise with people that have been mis-led, and those that will now further remove themselves further from engaging with financial services and the advice and support that many of it’s true professionals can provide.

I’m certainly not perfect but I do put a lot of energy and thinking and effort into ensuring that we, in our tiny role within financial services in Ireland, possess and develop our character and our competence as we serve clients. We try to help those that trust Informed Decisions with their financial lives. If you boiled it down to it, if all firms would genuinely try do something similar we’d probably be able to see the wood from the (fake plastic) trees.

Paddy.

If that last line makes no sense to you, ‘Fake Plastic Trees‘ was a song on the same album as The Bends 🙂

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.