Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

22nd March 2021

In order to stay relevant never-mind prosper, Financial Advice (like any other profession) must look inwards to improve, evolve and become more relevant to it’s target market. As a realist, I believe that if it can do that, it will not only become more relevant in future, but both the people in the profession and the clients it serves will prosper! Win-Win.

This week we explore the research on both the hard and soft data on the value of advice, testing the merits or otherwise on that, and seeking your input. Oh, I hope you enjoyed our piece last week where we shared the three main pitfalls of pensions for business owners.

Speaking of looking inwards, if you haven’t read it, you might benefit from reading our piece about the different sources of Financial Advice in Ireland here in Blog 96. That piece is over 2 years old now actually, but very little (if anything has changed since). Other than the forced progression to on-line communication the overall look and feel of financial advice in Ireland and abroad remains largely the same.

One area that I believe has changed is a growing desire from investors for a separation of advice from the product. What I mean by that is that if an investor wants to invest without advice, they can do so, and if they want to invest with the advice they can do that either. What is also coming more and more to the fore is that investing is becoming commoditised. Indexing is doing that, and it is thankfully removing a lot of the smoke and mirrors from investing and pensions. Once the broader public recognise that and are able to harness this, what investors/accumulators/spenders will actually pay for if engaging with advice is an expert and trusted hand on the tiller of their financial lives. That’s my take on it anyway.

Investors will ultimately no longer be paying for commissions to be paid to the advisor for having introduced them to the product provider. If the advisor is getting paid in the ‘new reality’, the onus will be on advisors to add value instead of merely selling product. This is a challenge that many within the advice community are ready and waiting for, but also you can see why large chunks of the advice community will not want that to be the case.

In Blog 153 last year I wrote about SPIVA research. SPIVA’s research time and again confirms something many investors had long suspected; Actively Managed Funds under-perform Passive Index Funds in the majority of cases. Of course, managed funds exist (among other things) to beat the market. They generally don’t succeed. Investors can and have therefore been able to get access to investment returns in line with their financial goals by investing smartly and prudently in index fund approaches. Investing is now commoditised. As a percentage of the value of traditional financial advice ‘picking your portfolio’ was where it was at! As a percentage of modern financial advice, I’d say it’s about 10%.

Another interesting piece of research shows that the trend continued through 2020 also – here’s a WSJ article titled, ‘Stock Pickers Trailed Market Again in Roller Coaster 2020 – WSJ‘.

Value is in the eye of the beholder of course, so if you are a recipient of financial advice, you will know what you like, dislike, value or not. What I am sharing below is some of the research (by parties who quite often have a vested interest!) that has been completed and what that might tell us.

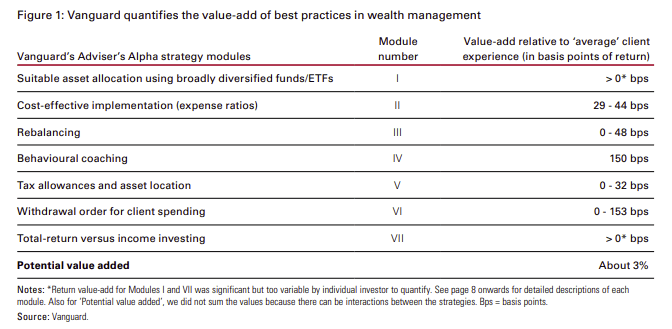

Vanguard have built a hugely favourable reputation over the decades for several reasons. One of which has been their commitment to offering actual value to investors. They also do a lot to promote actual financial advice, and through their research have informed and educated generations of advisors. Their UK research on ‘Advisor Alpha’ has been oft-quoted. Snippet below from that report shows where they suggest professional advice adds-value to investors.

Vanguard are very clear in stating that case by case will be very different, but their findings suggest an ‘alpha’ of about 3% per year additional returns for investors that work with an advisor, over those that DIY their investments/pensions.

3% is a big number here – even I am wondering if that is indeed realistic, but there are certainly cases where I have worked with clients over the long term where that would certainly be the case. For example, preventing a client from running to cash this time last year, probably saved them 35% or more, in one year, by the time they’d eventually have got back in!

As you will see above, that Behavioural Coaching offered by advisors (at least to clients that will listen to them!) is suggested to be worth 1.5% per year over the long term. I’d say in cases that number could indeed be many multiples of 1.5%.

We could spend all day going line by line through this and dissecting each piece – I’ll refrain – but what I will say is that if you don’t trust and listen to your advisor then you’ll likely not achieve any value over doing it yourself.

In July 2020 they published research by the following in the US; Ryan O. Murphy, Ph.D., He is head of decision sciences for Morningstar Investment Management, and researches how people make decisions, especially about risk and money, and he works on developing ways to measure people’s preferences. Samantha Lamas is a behavioral researcher at Morningstar. Her work focuses on answering impactful questions and communicating these findings to financial professionals and individual investors. Also involved was Ray Sin, Ph.D., whose a behavioral scientist at Zelle. A fairly accomplished team!

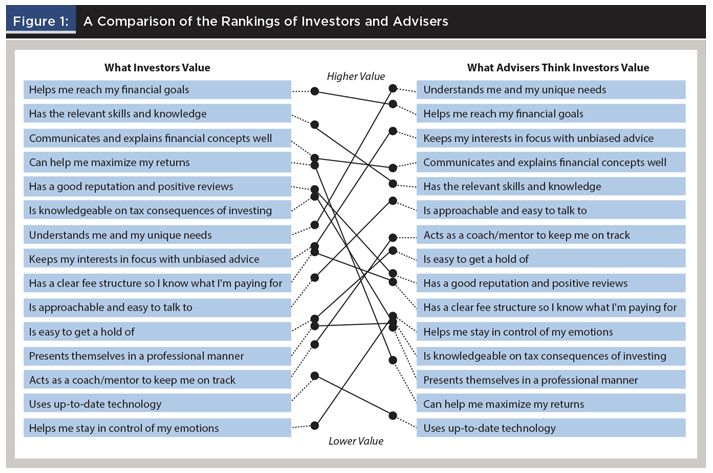

Link to the article is here. One of the most interesting things for me at least was the following chart:

Two things strike me about all of this.

Advisors only got 1 of the top 3 right, that of ‘helping me reach my financial goals’. The other two which investors actually value of ‘has the relevant skills and knowledge’ and ‘communicates & explains financial concepts clearly’ were missed in their top 3.

I guess the positive thing to come from this US research is that both investors and advisors place the attainment of results, an actual goal as one of main measures of the relationship.

Interestingly, that will require there to be a clear goal for the investor, and that’s where things can get interesting right! Understandably, most investors do not have a clear goal. It is one of the things that I encourage people to determine – what is the goal, what is the metric that we will work towards, and by which we can measure our success or otherwise!? Quite often, the goal will be less tangible and more emotional for investors, and I guess if that really is their priority when engaging with advice then that’s OK too.

When we step onto a plane (ah’ those were the days!), we do so without having to understand how the plane works in all it’s minutia, many of us don’t care. What we do principally care about is that it will get us to our destination safely and reliably. Secondly, we want it to be comfortable and hassle-free, and cost effective, and ideally we’d get free wine/beer and nuts, but them days are gone! Reliability is key and trumps all else for most of us.

I wrote a piece for Irish Times this weekend actually, and in it I hammered home the importance of reliability in our investments. Reliability, in my mind has become more and more under-rated in recent times, in all walks of life, not just financial!

Question 1:

Quick question Paddy if you can help please! Can you write off Investment Advice against Investment Gains? If so can these charges be rolled up from previous years as per example below Investment Profit (Shares) – €3,000 CGT Annual Allowance – €1,270 Investment Advice – €1,500 (500 for 3 years) Taxable Gain – €3,000 – €2,770 = €230 Tax Due = 33% on €230

Question 2:

Paddy, Your show is fantastic and I am really learning a lot listening to the current and back catalogue. In your opinion how is it best to manage currency risk in a pension? Disclosure – My own is fully invested in EUR lines in 3 different regional Vanguard Index Funds. 50 US, 10 EUR and 40 EM is the split. Thanks, Paul

Question 3:

Hi Paddy, first of all thank you so much for sharing your knowledge with the Informed Decisions tribe! Being non-Irish makes it even harder to navigate taxation regime in this beautiful country so I really appreciate everything that I’m learning here 🙂 Ok, here’s my question: Each month I invest some of my salary into ETFs via an online broker DeGiro. I started investing in 2020. Do I have to declare those investments when completing my Income Tax return for 2020 with Revenue if I haven’t sold anything? If yes, do you know how to do that? The ETFs I’m invested in are accumulative so dividends are reinvested automatically. Do I need to declare those dividends then? Sent this question to Revenue but still waiting for their answer. Thank you, Anna

And Thank YOU for reading!

Paddy.

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.