Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

11th May 2020

Wondering what the best investments 2020 are?! It is indeed one of those ‘once every 5 year’ situations for investments at the moment (more on that later), but we hope to share some insight that will help you see the wood from the trees, with your own equity-based investment or pension accounts.

If you are a regular or occasional visitor or listener of this site you likely have a fair idea of our response to the question of which are the best investments 2020. Short answer remains; investments which are low in cost, high in diversified equities and high in a decent track record versus it’s peers. But, has the sheen of that ‘Holy Trinity’ been tarnished based on how ‘things’ have gone so far this year!? Let’s see.

From the latest peak in mid-February to the latest trough in mid-April, was really rapid. It took 19 trading days to go from that peak to the trough, which is sudden, by any standards.

Of course there was nobody that had their eyes and ears open that wasn’t aware of that market decline – the media made hay on the back of the market’s turmoil. Less concerned with the best investments of 2020, the focus was on driving marketing spend. These same financial ‘journalists’ have been less prominent in their coverage of the market since mid April, where values are up, yes up, considerably.

Year to date, a 50/50 Equity Bond portfolio is approx 7% down, a 100% Equity portfolio is down 12%. These are just numbers, and to be fair, irrespective of the number, you should be carrying-on doing whatever you were doing, live your life, spend your money, save your money, or whatever your plan was before any of these markets did whatever these markets did before you started worrying about them!

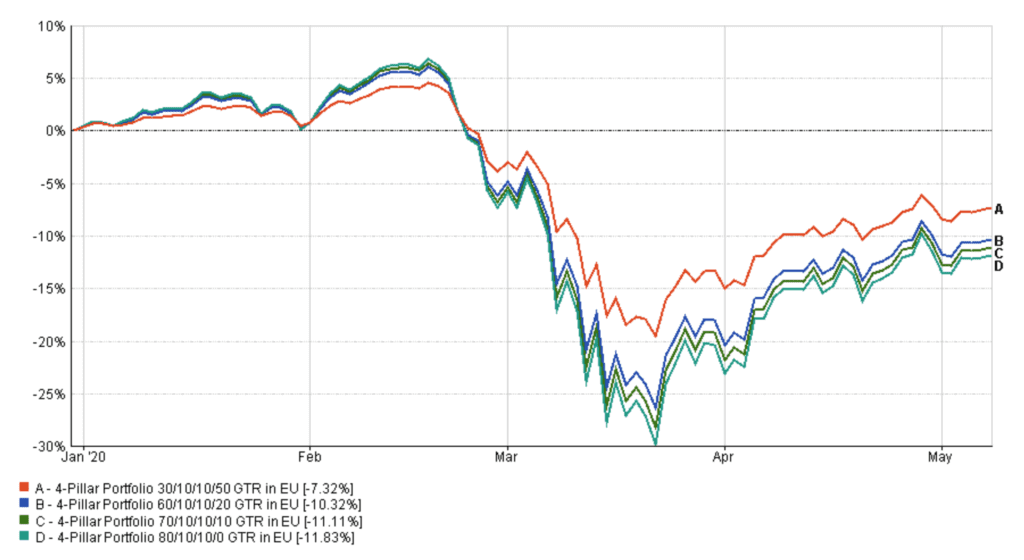

Best Investments 2020 – Year To Date Performance:

The above graph contains 4 sample portfolios I have illustrated for you. Each with a deliberately variable Equity and Bond proportions. Each of these contain a blend of Developed Market, Small Cap, Emerging Market and also Bonds.

50/50 Equity/Bonds: Having a large chunk of Bonds doesn’t save your portfolio from suffering declines in declining markets! It just dampens those declines, just as it does the advances. -7% YTD

80/20 Equity/Bonds: While considered a more ‘aggressive’ portfolio than the latter, this portfolio still holds one fifth of it’s value in Bonds – which again have not declined at the same rate as Equity obviously, so it now stands at -10% YTD

90/10 Equity/Bonds: Vast majority here is in Equity, just one-tenth held in Bonds, -11% YTD

100% Equity: The mother-ship – the one true ticket to long term wealth creation, as someone somewhere perhaps once referred to it (or perhaps in my imagination only). Holding zero Bonds, this portfolio is for the most stoic and patient investors, -12% YTD.

Best Investments 2020 – 10 Year Performance:

I was quoted in an article on Sunday 10th May, saying that investing for a timeframe of less than 8 years is speculating, not investing. I was being marginally provocative in that statement, but the principle of investing with such a time-frame is only magnified and reinforced in times like these:

Looking at the portfolios, in reverse this time:

100% Equity = +114%

90/10 Equity/Bonds = 102%

80/20 Equity /Bond Portfolio = 91%

50/50 Equity/Bond Portfolio = 60%

Best Investments 2020 – Perfect Correlation:

There has been, and will most likely continue to be, a direct relation between the % of quality diversified equity in your portfolio, and the long term returns you enjoy.

In the context of what is happening this year, for markets it is nothing new – it is the very volatility we have experienced time and time again. Now may be the appropriate time to mention a fact, heck lets call it an affirmation! On average, markets have temporary declines of 35% EVERY 5 years, after-which they are followed by significant and un-heralded growth.

Despite that, indeed, because of that, these equities (great companies of the world) deliver the returns that their patient owners (you the investor!) need. This is not to suggest that we experience a Global Pandemic every five years, but we do experience some very significant event that results in investors selling equity, the world to get fearful, markets declining temporarily, only to quickly begin furthering their advance.

It is far too easy to forget how terrifying the world was in 2008 during the Great/Global Financial Crisis (GFC, as it has become known as, how quaint!).

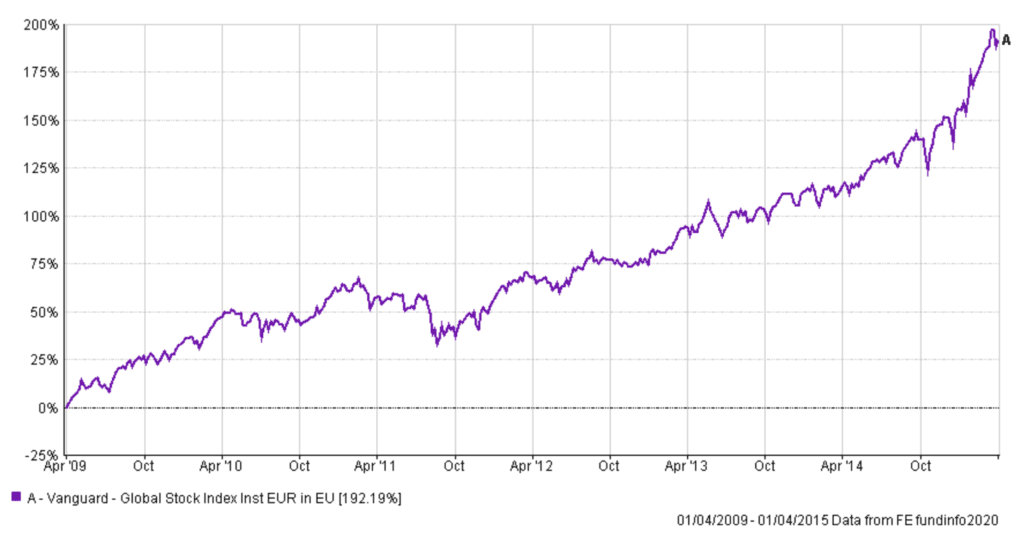

Over the course of 2008 and into early 2009, a quality Global Equity Market Fund such as Vanguard Index Fund declined by over 40%. For many then too, ‘the world was coming to an end’. Don’t every lose sight of that fear, that was as real then as it is now. The only comparison I am drawing between now and then is that sense of fear for the future. We all felt it, just as many of us do today.

What is important to observe is that the economy that we experience on a day to day basis (Ireland’s economy) struggled and spluttered along for the next 6 years before there was any hope or confidence again among the people. I got married in 2012, seems like a lifetime ago now, but even at that point, 4 years after the ‘GFC’, consumer confidence was low, unemployment was at over 14% here.

And remember, economies, not just our own were in the swamp, GDP rates were on the floor, unemployment was rife internationally, house prices were rock bottom, people weren’t buying houses. It surprises me now to recall, the old house we bought in 2014 had been on the market for around 2 years before someone as ‘crazy’ as us decided it would make a half decent long-term family home. Nobody was buying anything! You get the picture. It is only a few years ago, but we forget about the tough times and the all-consuming negativity so easily. It was ROUGH!

During those 6 years, from April 2009 to April 2015, what did that same Index Fund return to investors. Equity market delivered 192% during those 6 economically challenging years, as the world slowly recovered from the biggest economic melt-down it has seen in 90 years. 192% growth.

#In euro terms, €250,000 invested April 2009 was worth €730,000 in April 2015. (Today it’s worth a nose under €1m but that’s a side-point here!).

That’s how it goes, that’s how it has always gone. To put it another way, it has never gone any other way. If you say ‘ah, but this time is different’ – on what basis exactly are you stating that – and do you REALLY KNOW that it IS actually different!?

Conclusion – Best Investments 2020:

There has been a perfect correlation between equity and returns, blah blah blah. The numbers, while satisfying to some of us, really are quite uneventful. Personally, the real value to be gleaned from these types of analysis, is that rather than focus our attention on these numbers, we should focus our energy and plans on living the life we want to, to pursue the events, memories, achievements that will give us true joy.

Of course, all of which is best supported by your sensibly structured portfolios, and your empathetic and professional financial advisor. If you have one of these already, then please do hold onto them, thank them for the support they have offered you. If you have one that doesn’t care and doesn’t support, then you may benefit greatly from going and finding one who does.

Paddy

Blog 140 – New Central Bank Rules On Advice Firms Taking Commissions

Blog 127 – Best Multi-Asset Investment Funds in Ireland

Blog 133 – Absolute Return Funds – An Independent Review

Blog 130 – Investing in Emerging Markets

CCPC Website – Guide To Investing & Risks of Investing

This was our guide to the best investments 2020 – thanks for reading – as you know, past performance is not a reliable indicator of future performance – you could get back less than you invest with any investment, no matter how good it is – but usually only if you do the wrong thing at the wrong time!

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.