Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

28th November 2019

Emerging Markets might sound a little technical, but please do bare with me, even I can understand it, so you’ll be totally fine! It might even be worth your while reading on, if you ever intend investing in Emerging Market Index Funds in Ireland!

What Are Index Funds?

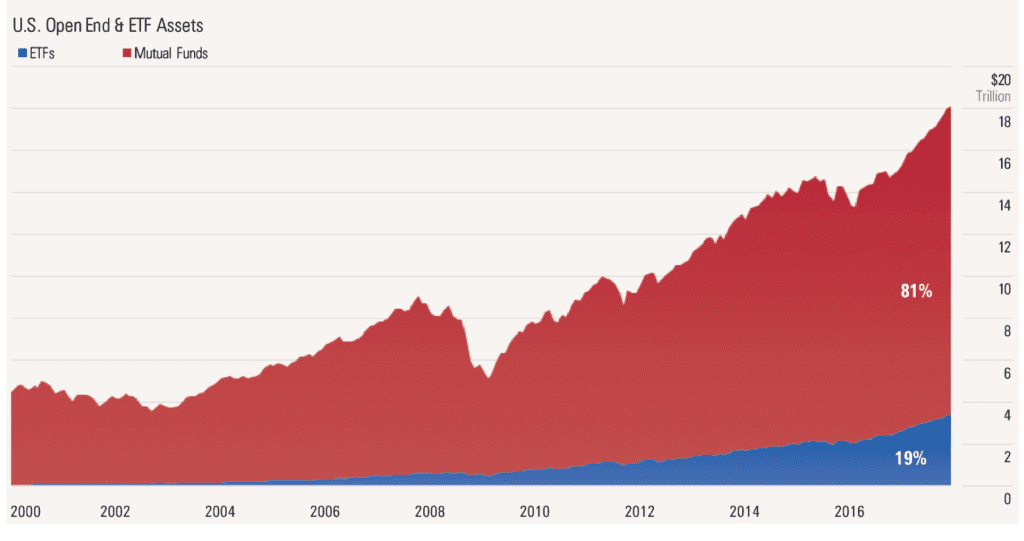

Some investors are sceptical of them, and totally understandably. In Ireland at least, people have been hearing and reading about them for only a couple of years. Some folk still perceive them as some sort of ‘new kid on the block’. It may surprise you to hear that index funds have been around and growing in popularity since August 1976! Even more surprising is that there has been a reported $280BN invested in Index Funds over the past 12 months, in the US alone! Graph below shows the growth of Index Fund investments from approx $4 Trillion in 2000, to $18 Trillion in 2018.

Data from The Investment Company Institute in USA shows that as at December 2017, 35% of total net assets in US mutual funds and ETFs were held by index funds, compared to 15% in December of 2007. Nevertheless, 65% of total funds were still managed by actively managed funds in 2017. As a percentage of total market value, index-based mutual funds and ETFs also remain relatively small. Index funds and ETFs made up only 13% of total US stock market capitalisation (value) in 2017.

Vast majority of investment products available through all the banks, brokers and advisors in this country are index funds, wrapped up in a bow and a nice title, with a saucy charge applied for the wrapping!

So you can say Index Funds are only gaining a foot-hold in smart investors portfolios. They are the alternative to what is often described as high-priced, self-serving products and funds offered by the old-brigade. When it comes to investing in Emerging Market Index Funds in Ireland, we really are at the infancy of what will be the dominant approach in the coming decades.

What Are Emerging Markets?

A friend of mine recently changed his car. Of course I had a cut at him for buying a 192, due to the cost of depreciation on new cars! Once we got over that I had to admire the car, a Toyota CHR, very unique and very fuel efficient, so not all bad! Anyway, point is that I had not seen one of these cars before, but once I’d seen one I couldn’t help but see them! Emerging Markets are a little like that for many of us. They get a lot of coverage, just that we don’t notice them, but my goodness are they there, and they are going to be more and more on our radar over time.

Investing in Emerging Markets Index Funds in Ireland

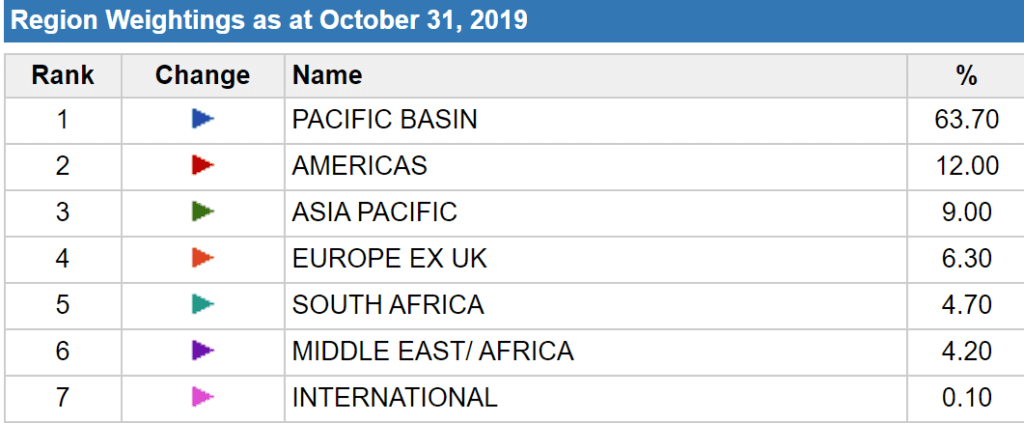

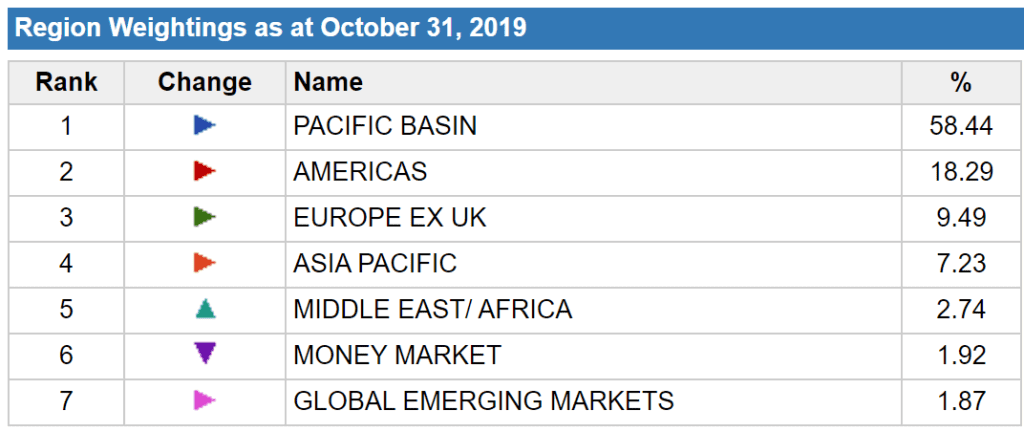

One should probably thread carefully in selecting an Emerging Market Index Fund,. Where it is domiciled can have an influence depending on whether you are investing via a pension or direct investment etc. There are many types of Emerging Market Funds, all of which can have different sector and geographic allocations. By way of example see the differences between two below, one from Vanguard and one from Blackrock.

How Have Emerging Markets Performed Versus Global Markets?

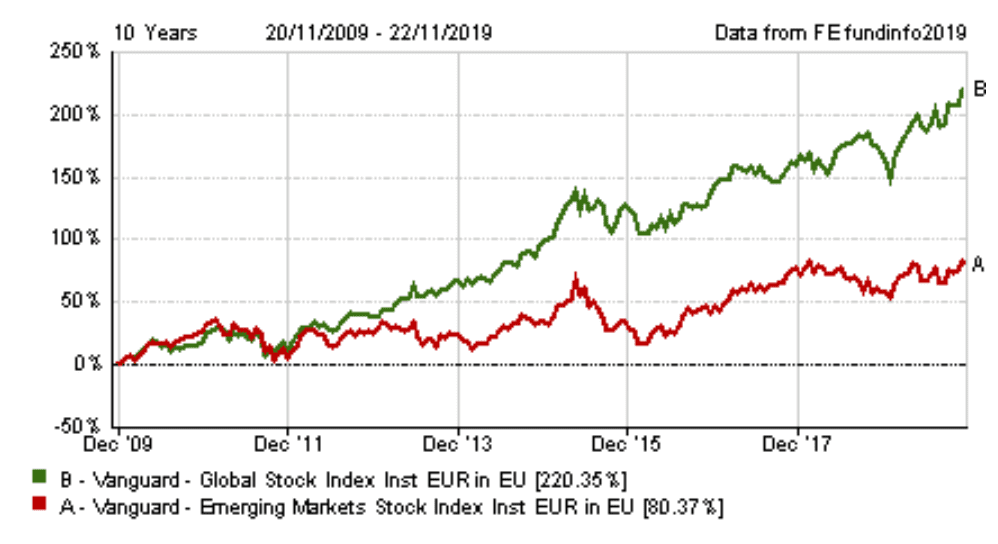

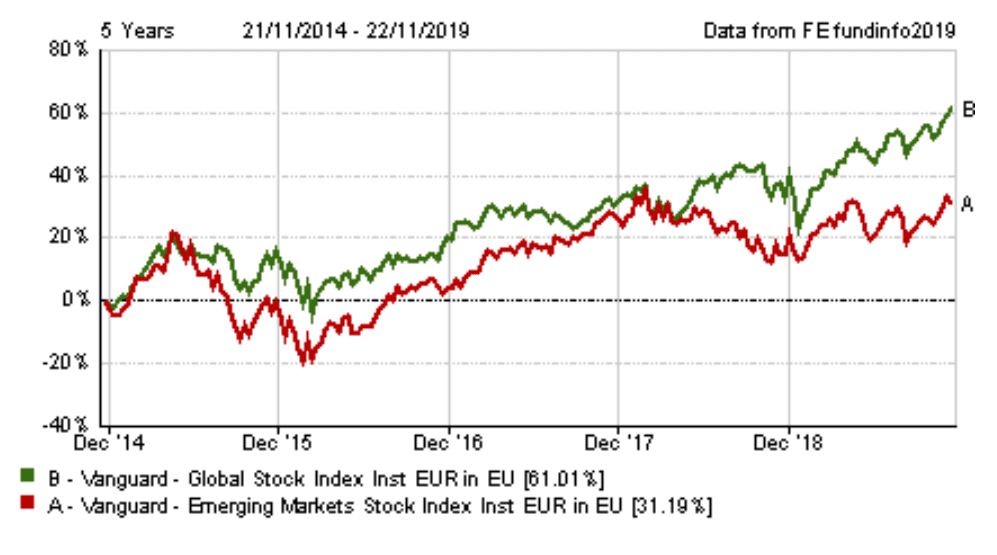

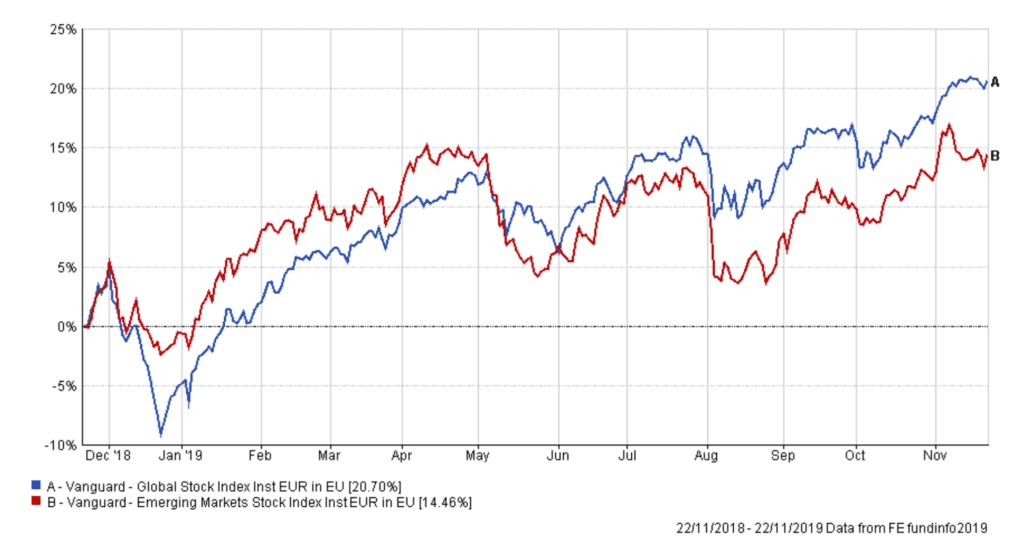

In this short snippet of general analysis I compare 2 comparative index funds. One is a Global Equity Index fund and the other is a Global Emerging Market Index fund. As noted above, you can take all different types and analyse the day-lights out of them, this is a basic piece of analysis to show how an investor would have fared if invested in one over the other.

Over 10 Years:

Over 5 Years:

Over The Past 12 Months:

It could be argued that if you had been heavily invested in Emerging Market Index Funds in Ireland over the past 1, 5 or 10 years, you would be happy with the returns you have achieved. You would be probably less happy were you to discover that your neighbour was invested in the Global Equity Index!

The Dawn Of The Emerging Markets Consumer

Future (stats on projected growth / potential / potential for all equities – just another factor of the constant upward curve….)

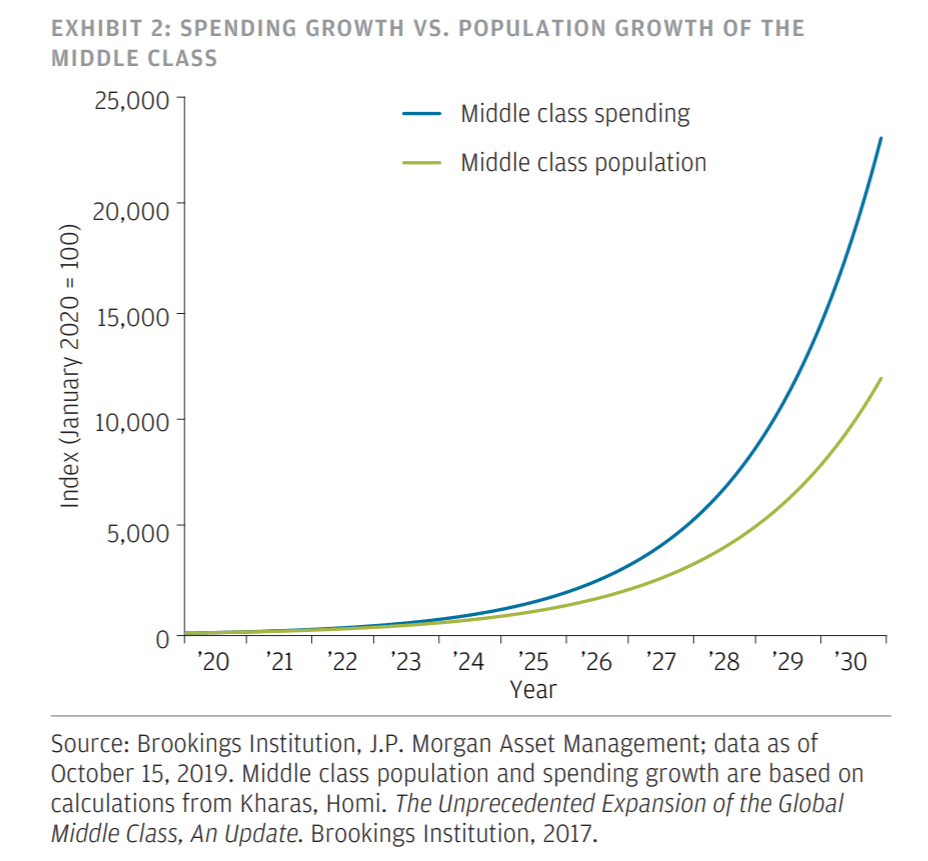

Exhibit 2 below, shows the supposed growth in spending and the supposed growth in population in Emerging Market countries over the next 10 years. As with all projections I’d take it with a large fistful of salt. Having said that, the rate at which the population % is progressing out of poverty is quite phenomenal. This growth, from a society and environment perspective, will carry it’s own challenges and opportunities.

From an investor perspective, it is this growth in wealth, in disposable income which is set to drive economic activity. When individuals have more income, invariably they spend more, buy more goods and services. Instead of having 1 pair of shoes they all-of-a-sudden feel they need 5 pairs! Instead of putting up with the pain they buy the medicines. Instead of taking the bus they buy a car. Instead of making do with few possessions they borrow to buy items, education, a more comfortable lifestyle. Heck, if you go back 50 years in Ireland you could say we were an Emerging Market ourselves! Just consider how our spending and consumption, and therefore our lifestyle has changed. The changes in these developing countries is really no different.

The great companies of these countries stand to benefit from this consumer spend. Therefore, investors in those great companies stand to benefit in returns from capital values and dividends. This is the same constant upward curve of equity market growth that we see across the globe since investing began, except concentrated on the markets of these specific countries.

This growth is projected to be particularly strong in Asia, driven primarily by India and China. It is said that 1.5 billion people are expected to enter the middle class in the next 10 years! This, if it transpires, will account for over 85% of the total number of people leaving lower class category (disposable income-wise) across the world in the next 10 years. America, which the globe relies on to drive much of it’s economic growth, is said to deliver approximately ‘only’ 10 million people into middle-class over those same years.

As a result of this, it is said that Asia will account for more than half the global economy by 2040. America currently makes up approximately 50% of global economy. So this could well be a changing of the guard, no pun intended!

Conclusion

The past has been kind to investors in Global Index Funds. and less so to investors in Emerging Market Funds, we do not really know if that differential will continue. Over the past decade the USA has delivered in the region of 13% annual growth. A Global Equity Index will typically hold in the region of 40-60% of companies of USA, which is proportional to it’s wealth generation abilities. It has served and will continue to serve investors handsomely over the long term. ‘experts’ are suggesting we should expect closer to 5/6% annual average returns in future decades, wherever they get that from I don’t know, not perhaps do they!

The same Global Equity Index might only hold 5-15% of the great companies of Emerging Market companies. I never listen to economists or ‘experts’ but the evidence projecting the future growth of the future GDP, population and wealth of these countries is quite hard to ignore. When it comes to investing in Emerging Markets Index Funds it’s something to consider.

Oh, please do complete our 2 minute survey below – which will feed into our White Paper research on trust in financial advice in Ireland…thanks so much.

If you would like to speak to Paddy directly about your own Financial Planning please get in touch via the contact box below, or check out the Work With Us section of the website.

Paddy Delaney

Resources:

Our recent Blog on Building An Investment Portfolio in Ireland

JP Morgan Emerging Markets Research

McKinsey Podcast – broad range of topics, some interesting guests

Morningstar Fund Flows Articles

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.