Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.

Retire successfully with Informed Decisions.

8th July 2019

Welcome to Ireland’s #1 Finance Blog!

How long will my ARF Income last? This week we continue our analysis of how we can actually go about drawing and maximising our pension and ARF incomes when we reach the age where we start to ‘spend’ instead of ‘accumulate’ our money.

For me at least this is the fun bit for us. We don’t have pensions because we want a pension, we have pensions because we want what it can potentially give us. Ultimately what it will hopefully give each and every one of us is financial independence and choice when we get to that stage of life. Unfortunately this is the bit that doesn’t get very well covered in media and education. What we tend to read and hear about is ‘the pension’ or ‘the ARF’ (the products people are trying to sell us!) – we rarely hear about the finer details, and the details that will be the most significant when we get to that stage. I aim to arm you with the ideas and knowledge now so that you can achieve tangible results when you get there yourself and you are drawing an income from your ARF or other pension funds.

We will be looking at two core aspect to Retirement Income Planning; Withdrawal Rates, and Dynamic Spending Strategies. First up are Withdrawal Rates.

What Are Retirement Income Withdrawal Rates?

When we talk about Withdrawal Rates we are referring to drawing an income from an ARF. Traditionally, and culturally, you will be told to take 4% if taking benefits between 60 and 70, and that you should take 5% once you hit 71, and to keep taking 5%. It is also cultural that you invest approx 50/50 in Equities and Bonds. We’ve covered this recently, so we’ll avoid repeating ourselves any further!

What this Revenue en-forced strategy doesn’t take into account is that you have control over the rate that you actually do take, you determine the ‘Withdrawal Rate’. Granted, you are unlikely to take less than the ‘imputed distribution’, because you will have to pay tax as if taking that amount anyway, but you can certainly aim to take more if you were so inclined!

The main types of Withdrawal Rate we should be aware of is the ‘Safe Withdrawal Rate’ of a particular portfolio. This is the annual % that we can take from a portfolio each year for the projected duration of our life, and for the portfolio to not go to zero. To put it another way, how much can I spend each year without having to worry about my pension running out!?

I recently came across an article by a ‘financial advisor’ in a national paper in which they claimed that the ‘4% Rule’ is nonsense, that investing in Equities or Bonds in retirement is nonsense, that even taking 2 or 3% per year from your pot per year is nonsense. I agree that there is no perfect or single-correct answer to each of our own personal retirement income planning, but let’s look again at the 4% Rule.

Will My ARF Last Me 30 Years?

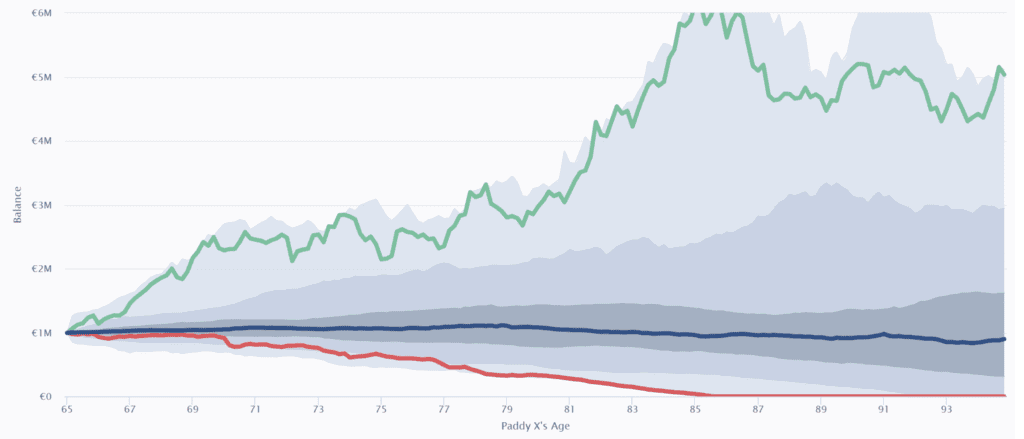

Lets take a scenario where you are 65 years of age. You have a sizable ARF/pension pot, lots of things that you want to do, and you are keen to go and do them, using the pension pot you have accrued. You hope to live 30 years to 95, in an ideal world!

You are being told that you should take the standard 4% per year, increasing to 5% from 71 on-wards. You will NOT increase your income in line with inflation each year. You are told that you should be invested say 40% Equities and 60% Bonds, to reduce volatility, or as some will refer to it as, risk! Finally, you are told you are paying 1.2% in charges on the fund (though depending on the type of scheme you have you can potentially double that!).

Regular listeners will know my own view-point on holding large swathes of Bonds in anything other than short term portfolios. Having said that the results for the above strategy have been, historically at least, quite interesting.

If you had started out with the above strategy in each of the past 100-odd years it would have worked out in 81 out of every 100 years. Beginning this strategy in 81% of all those years, this strategy would given you that income for the 30 years. That is a probability that some would be comfortable with, and others less so.

Speaking of comfort, what is also interesting is that the worst case scenario was that your fund was fully consumed after 20 years, your pot gone totally. Again, this is assuming a 40% Equity and 60% Bond portfolio. What is equally as interesting is that the Median value of your pot at age 95 was in around the same as what you started with, after 30 years of drawing income!

Where it gets less favorable looking is when we start increasing our incomes each year in line with inflation. As we shared in Blog 112 a couple of weeks ago, the impact of inflation on one’s retirement income is really significant, if your income is not increasing. Obviously, if you want your retirement income to increase with inflation each year it will put additional strain on your pension pots’ ability to survive over the long term.

Picture that you are drawing €40,000 this year and over that year the price of goods and services increases by say 3%. Assuming you are spending all of the income you draw you will most likely have a firm desire for that income to increase to €41,200 next year so that you can maintain your standard of living. And so on and so forth for the duration of your life. If you do that in the above scenario however it only worked out in 30% of occasions. Worst case scenario was that your pot was fully drained before 80, and the median was your pot expiring 6 years before you do – which is obviously not a good outcome for anyone.

Can I Take 4% (And Then 5% from 71) From My Pension Pot?

Interestingly, the research here suggests that we can and you cant! If we are insisting on holding large % of Bonds in our portfolio, as is customary, history won’t be kind to us. If we are going to inflation-proof our income we stand a miserably poor chance of making that pot last us anything more than 20 years.

What is quite terrible about this is that this is exactly what the majority of retirees are actually being told to do. What is equally as shocking is that a lot of the ‘advisors’ that are telling people to do just this have no clue whatsoever what they are doing. They are just doing what they have been told to do. They probably (at least I hope they don’t) realise that they are most likely walking many clients into a later life with little income and therefore little dignity and freedom.

There are ‘Spending Strategies’ whereby you manage your spending rates each year based on the performance of the portfolio, which can significantly increase both the longevity and indeed the total overall income that you derive from the portfolio. Likewise even a slight shift in the portfolio composition, in hand with flexible spending strategies can have a really significant impact. Be sure to join us next week when we take a look at the impact that these approaches can have in euro and cents terms!

Thanks,

Paddy Delaney

Informed Decisions are one of Ireland’s only remaining independent financial advice firms. We specialise in retirement & investment planning for successful individuals, so that our clients only have to retire once.